)

The fall of Wirecard is bad news for Fintech. And it’s important to understand why the failure of one player can have such an impact on the whole ecosystem. The answer can’t be just more regulation.

Last Friday, the Financial Control Authority of Great Britain (FCA) suspended the licence of Wirecard Card Solutions Ltd., a subsidiary of German parent company Wirecard AG. The majority of people have only heard of Wirecard as Europe’s Fintech superstar, but don’t know much about its services.

But overnight, individuals and businesses found themselves unable to pay or access their money.

How is this possible? How can the fall of just one player have such a profound impact on an entire industry? And above all: how should the fintech ecosystem react to prevent this from happening again?

I won’t go into the details of the suspension of Wirecard's license. But as the founder of a young fintech company, I want to shed light on the wider ecosystem, the obstacles for startups in this sector, and the challenges posed by the fall of Wirecard.

Because frankly, this is bad news for our industry. And we have to take the right steps to restore a cracked reputation if we want to achieve our common goal: a revolution in financial services through innovation and technology.

Why payments are so complex

We created Spendesk because we saw a huge gap between what businesses wanted from their financial services, and what the market was providing. Innovative technology could fill this gap; financial services could definitely be better.

In fact, this revolution was already underway in the B2C world. Revolut and N26 - among others - had completely changed retail banking. So we launched Spendesk to bring the same level of innovation to the B2B world - to reinvent the payment experience at work, and to give finance teams more control over business spending. And to do that we needed to join the payments infrastructure.

But the payments world is complex – not purely because of technology, but also because it’s obscure and difficult to access for newcomers.

On the one hand, there are regulatory issues: from the moment you handle money, you’re subject to obligations imposed by financial supervisors in each country.

On the other hand, payment networks (like Visa and Mastercard) are owned by very few players, and access to them requires substantial investment. And there’s no good way to get around these networks.

Two options for fintech startups

Entrepreneurs who wish to innovate in the sector have two choices. The first is to obtain a licence - the authorization to operate as a payment institution. This lets them connect directly to the various networks.

But obtaining this licence is a slow, costly, and uncertain process, and requires long-term financial stability – not usually suitable for an innovative service that has yet to prove itself in the market. A typical entrepreneur must wait 18 months before they can launch their first product.

The second option is to turn to players with existing payment services. They’re regulated and connected to the various payment networks, and can offer their "white label" license to other companies. The most modern ones have interfaces that connect to the various payment networks and manage the entire financial side of the business: customer accounts, issuing of payment means, processing transactions, and more.

For new businesses, this reduces the time to market considerably, and brings the costs down too. Their product becomes dependent on these players, but this is the natural choice for most at the beginning.

The immediate impact of Wirecard’s collapse

Today, there aren’t many of these players in Europe for fintech entrepreneurs to choose from. Among them, one of the biggest is Wirecard. Many fintechs use Wirecard to integrate payment services into their offer, under Wirecard’s license.

Which means: if Wirecard is no longer allowed to operate, they can no longer operate.

The UK regulators have suspended Wirecard's licence temporarily, which means they can’t operate as a payment institution. As a result, all fintechs that relied on Wirecard were forced to suspend their activities. And end users, both individuals and businesses, were cut off from their means of payment and their money, overnight.

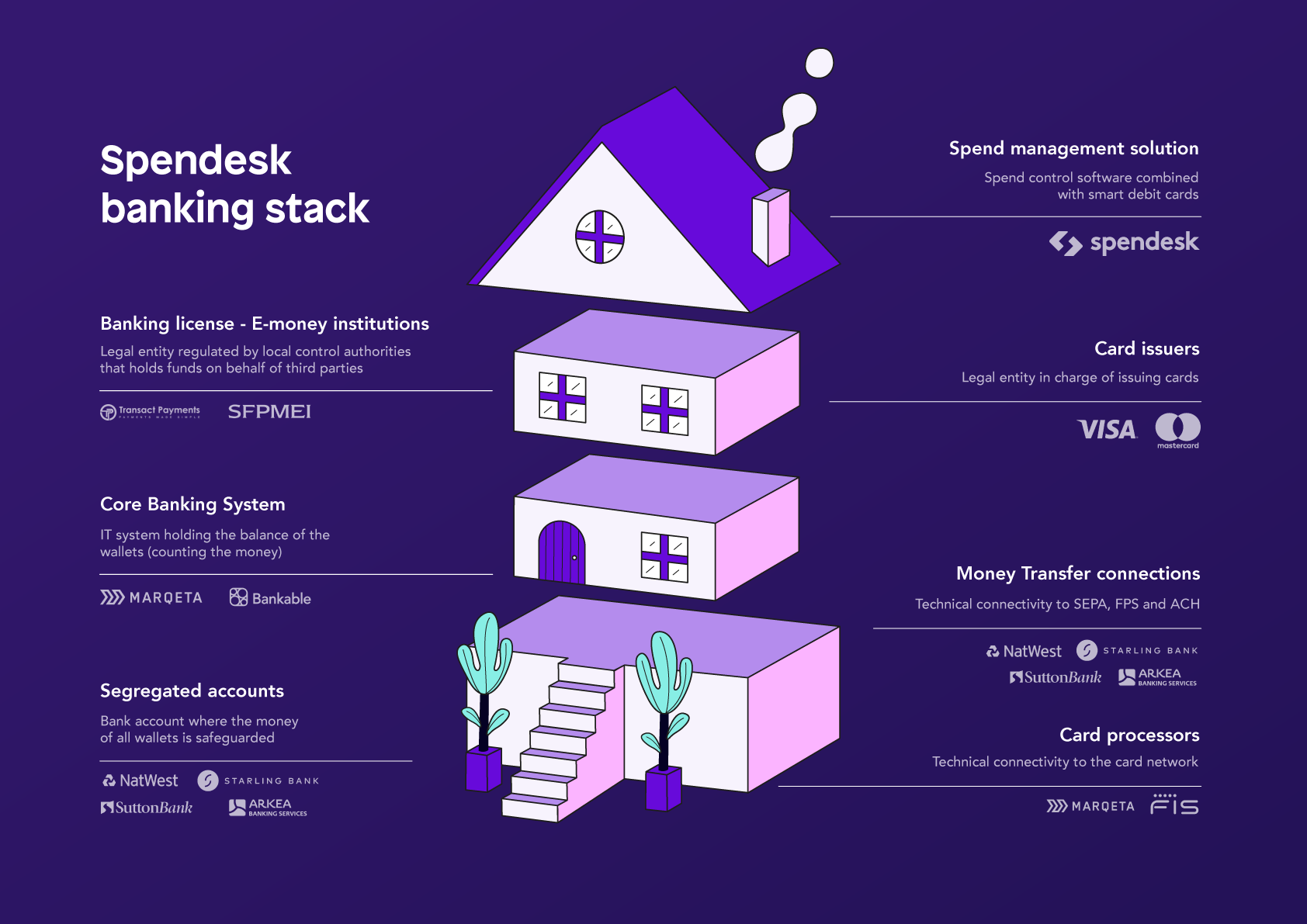

The Spendesk financial stack

At Spendesk we don't work with Wirecard. And from the beginning, we sought to diversify risks by working with several players in parallel. Should one of these players fail, we can continue to serve our customers.

So our business is not at risk. But what’s happening now to fellow fintech companies could have affected us as well, and so we’re pushing for change.

Let’s redesign the payment sector

There’s a lot at stake for our ecosystem and fintech in general. On the one hand, we still have an incredible opportunity to bring about a financial services revolution. The financial sector is run by aging companies in a quasi-monopoly, struggling to reinvent themselves.

It’s an extraordinary breeding ground for new products, higher standards, and fewer market imbalances. We have almost unlimited opportunities for innovation, made possible by modern technology and creative problem solving.

But of course, money is a sensitive subject. The underlying regulations are important and necessary, and we need these to remain robust. But together with the concentrated access to networks around a few players, there’s a significant barrier to entry.

This makes innovation and entrepreneurship particularly difficult in fintech. We need to enable strong innovation by opening up the sector, while ensuring that regulatory requirements are met.

The fall of Wirecard shows the consequences of centralizing innovation around a few players whose failure impacts the entire system. It can also create a climate of distrust towards newer financial services for the wrong reasons. And that hurts all of us.

Finally, it provides additional leverage to the giants of the sector, who already control the systems and have no interest in seeing new entrants. They can now strengthen their dominant position by pushing for tighter regulatory controls on new challengers.

How fintech can still succeed

The reaction from the authorities will likely be tighter regulations. And that’s understandable. But in my view, this clearly won’t fix the problem. We have three pressing challenges:

To encourage new players to emerge who can decentralize access to payment systems.

To implement complete transparency across financial flows. This must enable continuous and automated monitoring, and ensure compliance with regulatory requirements.

To create more diversity in the system, and prevent dependence on just a few players. Look at the impact of the failure of only one player - a relatively very small one. What would happen if a major player such as Visa or Mastercard were to fail?

To face all these challenges, fintech players need to mobilize, to work with the supervisory authorities, and to develop these systems. We’re building real solutions for significant problems. And the only way forward is technology.

)

)

)

)

)

)

)