Everyone knows how much of a pain it can be to deal with workplace expenses, especially the expense approval stage.

Why? The endless delays.

Delays for the employees waiting weeks to be reimbursed for expenses. Delays for the managers waiting until the end of the month for a clear overview of expense spending. Delays for the finance team having to chase people for the right expense documentation.

Sometimes, it feels like every step of the expense approval process is designed to take as long as possible. With all this waiting around, it’s no wonder managing business expenses is one of the things employees complain about most often.

Fortunately, there are ways to manage workplace expense approvals securely and conveniently, with zero delays.

What are expense approvals?

Expense approvals are a crucial step in the expense management process. It’s where managers track and approve employee spending.

If there’s not already a good expense management policy in place at your company, things can get messy.

In a classic expense management workflow, there are several parts to the approval process. After the employee spends money related to business and submits their expense report, they must wait for a manager’s approval before they receive reimbursement from the finance department.

The expense approval step is an important piece of the puzzle. It should be as straightforward as possible.

Modern companies do not need to adhere to these clunky processes and long waiting periods. There’s a better way: automated expense approvals.

Why track employee expenses?

Most companies choose to stick with the boring old expense report process. While this is clearly still a common way to deal with expenses, it's far from ideal.

Expense reports come with significant problems for your business. Most obviously, they cost a huge amount of time to file and process.

But even worse, expense claims are seriously prone to error, and even downright fraud. Some individuals admit to claiming up to $25,000 in false expenses every year. Which is a pretty horrifying amount.

And they're just annoying for employees - both travelers who claim and the finance team members who process them. Expense reports put a real dampener on what should otherwise be productive work.

Which is why we're certain that expense automation is a smarter choice that leads to more streamlined expense approvals. And even better, give your teams their own expense cards and eliminate expense reports altogether.

Pre-approved expenses vs manual approvals

When it comes to approving expenses, there are options. Approval can be granted before the expense or afterwards.

Pre-approved expenses

Pre-approval means that even before the employee spends money, the expense is already authorized and ready to go. A manager has already verified that the expense is necessary, complies with the expense policy, and fits within the budget.

There’s no guesswork involved. The budget is updated in real time and everyone maintains visibility.

Manual expense approvals

There are a few more steps involved in manual expense approvals. But, it doesn’t have to be a laborious process.

Manual approvals come after the expenditure. The employee provides proof (usually a receipt), and submits it to their manager. The manager checks and then approves the expense. The manager sends it on to the finance team, who also must approve the expense.

The good news? With an automated process, this can be quick and painless.

How to automate expense approvals

With modern spend management tools, every step of the process becomes instantaneous. No matter who you are or what your job is, it saves you valuable time and effort.

If a team member is out in the field and needs to make a work-related purchase, they can use a debit expense card just like a typical credit card. If the purchase is within their pre-approved budget for the month, it’ll be processed as quickly and easily as any other Mastercard purchase.

But if the purchase does require approval, a push notification is sent to their manager to review and approve in real time. This means no uncertainty, and no waiting around.

For managers and finance teams, the software tallies and processes team expenses in real time as expenses are paid and approved.

This gives you a detailed, up-to-date total of expenses at any time. You can say goodbye to nasty expense surprises at the end of the month.

The expense tracking tools you need

The top tools use a range of handy features to make every step of the expense tracking and approval process seamless, easy, and above all, fast.

This includes a centralized real-time dashboard, prepaid expense cards, instant receipt scanning, and a virtual credit card facility.

Let’s take a closer look at each of these features in turn.

Centralised expense dashboard

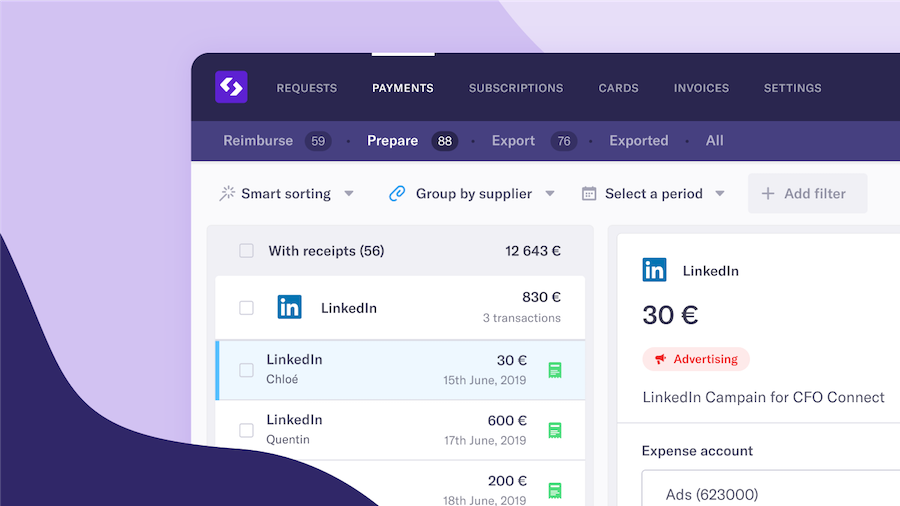

All expense purchases should appear in real time in the web or mobile dashboard, with all expense information gathered in one handy place.

Rather than waiting until month’s end to get a sense of company expenditure, managers and finance teams can keep a close eye on who spends company money and what they’re spending it on, all in real time. This makes the expense approval process a breeze.

This integrated dashboard also lets managers plan for recurring expenses in a simple and easy way. For example, managers can view all employee subscriptions in one place, and will receive notifications when these are about to expire.

Debit expense cards

Remember the pre-approved expenses mentioned above? Prepaid expense cards let managers tailor the expense budgets allocated to each team member and for each category of expenditure.

For example, a sales manager could set a monthly travel allowance reflecting the additional travel requirements of the team. Whereas the marketing team lead could set a monthly allowance for marketing costs.

This not only puts managers in the driver’s seat, it also gives employees the freedom to spend company funds within set categories without having to ask permission first.

Tools like Spendesk also allow for new spending requests to be approved automatically or manually, whichever you prefer.

Managers can even set spending limits to zero, meaning every expense request will send a push notification to the manager’s smartphone for instant verification. If the manager doesn’t approve the request, the funds won’t be spent.

With prepaid expense cards, you and your team can avoid the hidden costs of expense claims, as well as sidestepping the security challenges of a shared credit card.

Instant receipt collection

Are you all-too-familiar with the pain of collecting expense receipts? This is perhaps the most common headache for finance teams.

The fix is simple: staff just have to take a photo of the receipt, and the spend management tools do the rest. The receipt is attached directly to the transaction, along with the request and manager's approval.

Spendesk also features one-click exports to accounting software, making it quick and easy for finance teams to reconcile expenses. Voilà, instant expense approval!

Virtual credit cards

Virtual credit cards let employees access single-use virtual credit cards in just a few clicks whenever they need to make a payment online.

These virtual cards are single-use only, meaning they can’t be used for any non-approved purchase.

This allows for quick and convenient online spending, and also saves employees from having to share company credit card details, which can contribute to workplace expense fraud.

Once again, the virtual credit card facility allows for instant manager approval, giving managers close oversight of online company expenses.

Smart travel management

Company travel is a common challenge. You have non-finance employees travelling for work, and they need clear guidelines and rules to make sure it all fits your travel expense policy.

But it also needs to be easy, efficient, and enjoyable.

That's why tools like TravelPerk are so valuable. TravelPerk lets team members choose and book the options that suit them, but always within policy. Most importantly, their manager or finance has the chance to approve (or pre-approve) the trip before money is spent.

And TravelPerk integrates with Spendesk, which means you have smart spend approvals at the travel booking, payment, and bookkeeping stages. Ideal!

A clear & simple overview of company expenses

Spendesk doesn’t just save time through instant expense verification: it also provides a simple overview of every step of the spending process, tracking expenses from order to payment.

With Spendesk, managers and finance teams have access to clear, customisable approval flows for purchase requests, giving greater certainty and confidence over the use of company funds.

Every company dollar spent can be tracked in detail. For cash-strapped startups, this can make all the difference.

Time is your most valuable resource - don’t waste it!

With integrated expense solutions like Spendesk out there, there’s no longer any excuse for subjecting your team to the hell of clunky expense claims or shared company credit cards.

Through automating standard expense processes, Spendesk not only cuts down the time and hassle of managing expenses, but also gives you and your team added confidence and security.

Spendesk makes every step of the expense management process instantaneous, including tracking and approving expenses. putting managers in the driver’s seat and ensuring certainty and security in managing expenses.

Curious how Spendesk works?

Try an interactive demo to see spend control and approvals end-to-end.

Get a free tour

)

)

)

)

)